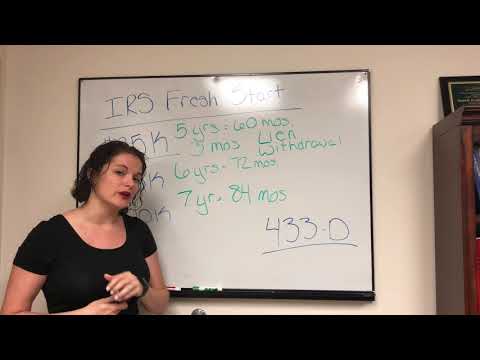

Hello, Amanda Kendall Harris. I am here to talk to you about the IRS Fresh Start initiatives. There is a lot of information available on the Internet regarding these initiatives, but I want to break it down and give you an overall view of what they really are. The Fresh Start initiatives are installment agreements with the IRS. There are three different ways to set up installment agreements based on the amount you owe. If you owe more than certain amounts, you may not qualify for the Fresh Start installment agreements. However, you may still be able to qualify for another installment agreement. The first installment agreement we will discuss is for tax liabilities of $25,000 or less. With this agreement, you can set up an installment plan over a period of five years or 60 months. It is important to note that this agreement requires a Direct Debit setup from your bank account. If you owe less than $25,000 and have made three consecutive payments through direct debit, you can request a lien withdrawal for any tax liens filed against you by the IRS. A lien withdrawal is beneficial as it allows you to remove the tax lien from your credit report, as if it was filed in error. The second installment agreement is for tax liabilities of $50,000 or less. This agreement allows you to set up an installment plan over a period of six years or 72 months. The IRS will not require detailed financial information or ask questions about your ability to pay if you can come up with a payment plan that pays off the tax liability within the agreed time frame. Similar to the first agreement, this also requires a Direct Debit setup. The last installment agreement is known as the expanded streamlined installment...

Award-winning PDF software

Video instructions and help with filling out and completing Fill Form 2220 Installment