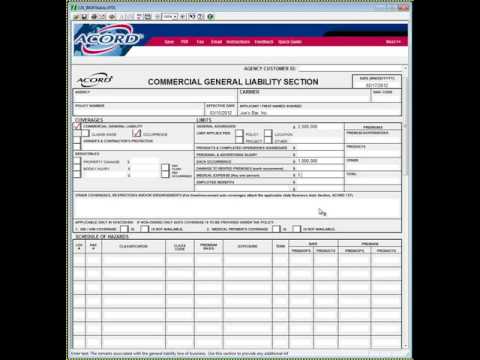

What we're going to go over here today is the cord 126 which is the general liability application mm-hmm with that being said what I have up here in front again I used a court advantage to get this application but this is the Accord 126 the general liability section and as we discussed last time on the 125 you would complete this application any time that you need liability coverage on commercial lines and you just fill this out along with the 125 that you fill out each time so without further ado let's go ahead and just kind of get clicking through here so hmm first off we just start with the easy stuff today's date and then if it's access plus you would leave this information up here blank agency and carrier and that sort of thing you can fill this in if you're sending it in through your own office however we do want to put down what date you would like this policy to be effective so we're just going to say it's due on the 15th of March and again we need to put down the policy applicants first name insured and as we discussed last time if it's a sole proprietor we would just put down the sole proprietors name doing business as whatever the business is or if it's in in court of a corporation an LLC we would actually put down the name of the LLC or corporation because that would be the entity okay so depending on what the name insurer it is that's how that would be and then and if anyone has questions on that to be happy to help them um nix down here on the commercial general liability section um we're gonna obviously check that I...

Award-winning PDF software

Video instructions and help with filling out and completing Fill Form 2220 Liability