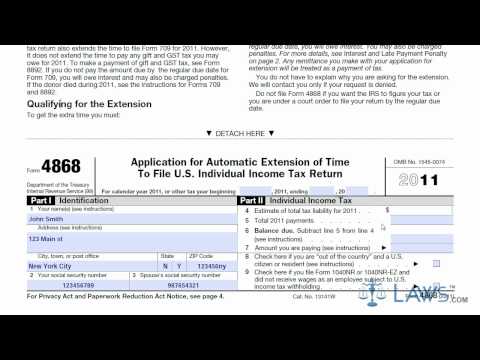

Laws calm legal forms guide form 4868 is the United States Internal Revenue Service tax form used for requesting an automatic extension of time to file a personal income tax return. It does not extend the time to pay the tax, but merely extends the time before a more formal individual tax filing is required. The form 4868 can be obtained through the IRS's website or by obtaining the documents through a local tax office. The tax form is to be filed by the individual requesting the extension to file their personal income tax return with the federal government. You will not need to explain why you are requesting the extension of time; however, you will need to contact the IRS if your request is denied. First, find the form 4868 tab at the bottom of the form. In part 1, record your identification information, including your name, address, city or town, state, and zip code. Put your social security number in line 2. If you are filing a joint return with your spouse, put your spouse's Social Security number in line 3. For Part 2, you will need to calculate your total tax liability for 2011. In order to calculate this, you must use a 1040 form to calculate your taxable income and tax liability. Enter your estimated tax liability for 2011 on line 4. Enter your total tax payments for 2011 on line 5. Indicate your balance due on line 6, which is the amount you will be paying for your 2011 taxes with your form 4868. If you are residing outside of the United States, you must fill in the appropriate forms in lines 8 and 9. You may request foreign income tax forms if you have not received them. You are now ready to send in your form 4868 with an...

Award-winning PDF software

Video instructions and help with filling out and completing Fill Form 2220 Reform