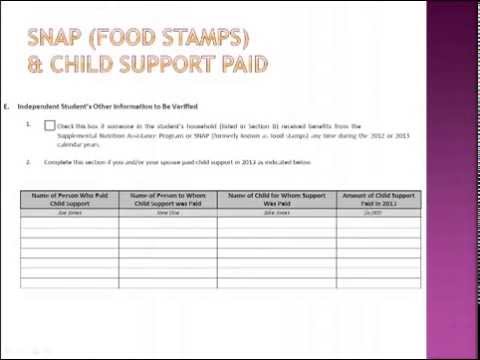

How to complete the financial aid verification worksheet. This presentation will help you get it right the first time. Students are randomly selected by the Department of Education or by the school for verification. Verification means that the financial aid office must check certain answers on your FAFSA for accuracy. You are required to complete a verification worksheet for this process. A financial aid specialist will compare your answers on the FAFSA and on your forms. If any corrections need to be made to your FAFSA, we will make those for you. There are five different verification groups. Each group is required to provide different information. This means there are five forms for independent students and five forms for dependent students. The following instructions will show how each section of all forms should be completed. You may not have all of the sections in this presentation on your form, but this will show you how to complete the ones that you do have correctly. Be sure that you print the correct verification worksheet for you. The form number was emailed to you and is in WebAdvisor under my documents. The first section of the form is student's information. Please be sure to complete all fields on this section of the form. Also, please note that changing your address on this form does not change it school-wide. If you have moved, please update your address with the registration and records office as soon as possible. Most verification forms require that you list people in your household. This household is for an independent student. You should list yourself first, list your spouse if you're married, list any children if you provide more than 50% of their financial support, and then list any additional people who currently live with you and you provide...

Award-winning PDF software

Video instructions and help with filling out and completing Fill Form 2220 Verified