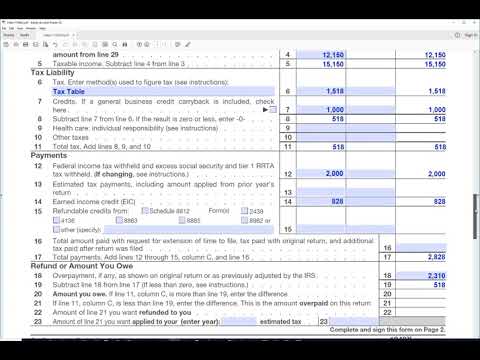

Hi, this is John with PDF Tax. This is Form 1040X, the amended individual income tax return, and we're going to look at what happens when you change the exemption amount. So I've set this up for Fred and Margaret Jones, who are married filing jointly. I'll check that . This is for the year 2017, and we'll assume that they filed their original return with just one dependent. However, they forgot to include the second one on their original return. So they need to add that back to get the exemption for the second dependent on the 1040X, which is what we're going to do right now. First, I'm going to fill out this column for the original amounts. We'll say they had $40,000 of wages. Then, there's a deduction for 2017 for married filing jointly, which would be $12,700. On line four, for their three dependents, they have an exemption for themselves plus their one dependent, for a total of three, which is $12,150 (3 x $4,050). On line six, they computed their tax using the tax table. The tax for married filing jointly for $15,150 would be $1,518. They did have one dependent on their original return, who was under 17 years old, so they got a child tax credit of $1,000. On line 11, the total tax comes down to $518. They also had $2,000 of income tax withheld, and on line 14, they had an earned income credit of $828, as they qualified with just one dependent. Their refund on the original return was $2,310, which needs to be put on line 18 as the overpayment shown on the original return. To add the second dependent, we need to scroll down to page two, where we change the exemptions. Initially, they had two exemptions, one for each of them...

Award-winning PDF software

Video instructions and help with filling out and completing Form 2220 Exemption