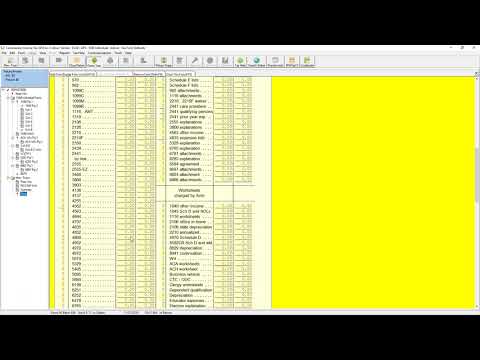

Today, I'll be showing you how to set up defaults and assign them to other users. Once you log into the software, make sure you're logging into the admin user because it has the privileges to do the tax form defaults. Go to the tool menu and select edit tax form defaults. Select the package, such as 1040, that you want to work with. Confirm by selecting "yes." This is where you can set up your default and bring in the forms that you know will be widely used in most returns. For example, I'm going to scroll down and enter the bank product and select EPS to have the EPS forms included in the return. I'll also enter my five-digit ero pin, select "check here if using practitioner pin," and select the income tax. After that, I'll hit "I authorized" and fill out the third-party designee and prepare information. Once I've filled out these details, I can start bringing in the forms that I know will be widely used, such as a w-2, 1099, or a Schedule C. To do this, I'll type in "w-2," double click on the form, and bring it in. Since most customers have an earned income credit (EIC), I'll go back to add form and type in "EIC" to bring in the EIC worksheet and the 8867 form for due diligence. After pulling in all the necessary forms and setting up my defaults, I can go to the "prep use form" section and add a question like "How did you hear about us?" by right-clicking and selecting "edit history list." This allows me to enter different answers like email, newspaper, Facebook, etc. so clients can choose one from the drop-down. It's a great marketing tool. I can also highlight certain questions, such as "How...

Award-winning PDF software

Video instructions and help with filling out and completing Form 2220 Preparation