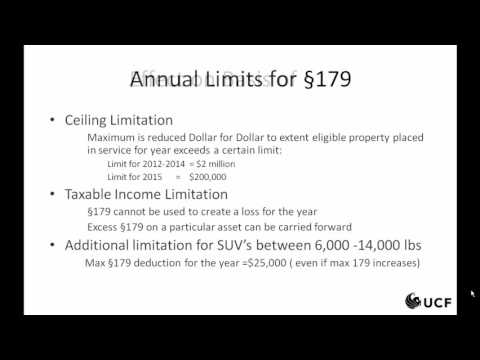

Welcome, my name is Marci Hampton and I'm a faculty member at the UCF Dixon School of Accounting. In this short lecture, I'm going to talk about makers depreciation. This is video 3 of a 3 video set. This video will deal with section 179 and bonus depreciation on tangible personal property. With tangible personal property, we have the ability to expense assets under what we call section 179 of the Internal Revenue Code. This is an election that we can make to immediately expense an asset's cost or part of its cost instead of depreciating it over several years. This is, of course, subject to limits. Section 179 is only available on tangible personal property, not real property. You will also note that there is an annual election that we make on the property placed in service in the current year, and it is only available in the year that we place the asset in service. So, what is the maximum amount that is allowed to be expensed under section 179? This amount changes every year. For 2012 through 2014, the maximum amount that you could expense under section 179 was $500,000. As of January 1st, 2015, the limit was reduced back down to $25,000. That is likely to be extended back up to $500,000 before the end of 2015, but at the time of this video, it has still not yet been extended. Please note that the limit for section 179 is per taxpayer per year, not per asset, and it can be split over several assets as desired. Further limits that we have for section 179, the first of which is what we call the ceiling or threshold limitation. We have a ceiling or threshold that we cannot exceed. If we place more than the ceiling limitation in service of tangible...

Award-winning PDF software

Video instructions and help with filling out and completing How Form 2220 Depreciated