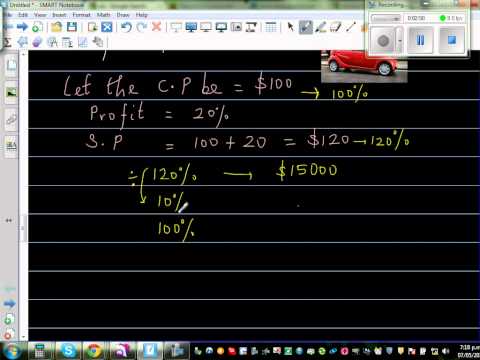

A car dealer bought a car and added 20% to the cost price. The car was then sold for $15,000. The task is to determine the original cost price of the car. Let's assume the cost price to be $100. Since the dealer added a 20% profit, the selling price would be $120 (cost price + 20). To simplify the calculations, let's consider the selling price ($120) as 120% of the cost price ($100). If we want to find the cost price, which is 100%, we need to solve for the value. So, 120% is equal to $15,000. To find 100%, we divide $15,000 by 120 to get the value of 10%. $15,000 / 120 = $125 Therefore, the value of 10% is $125. To find 100%, we multiply $125 by 10. $125 * 10 = $1250 Hence, the cost price of the car is $1250. To calculate the profit, which is 20% of the cost price, we multiply $1250 by 20%. 20% of $1250 = $250 Therefore, the profit is $250. Finally, to calculate the selling price, we add the cost price and the profit. Cost price ($1250) + Profit ($250) = Selling price ($1500) Thus, the selling price of the car is $1500. In conclusion, the cost price of the car was $1250, and it was sold for $1500, with a profit of $250.

Award-winning PDF software

Video instructions and help with filling out and completing How Form 2220 Percentages