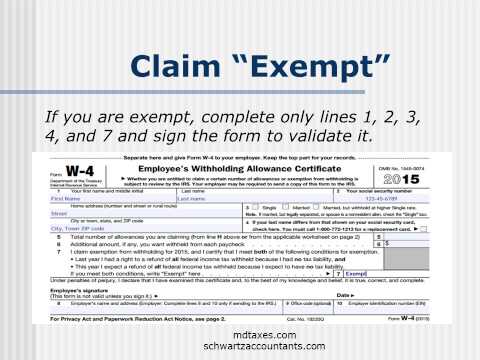

Hi kids Andrew Schwartz here to discuss how to fill out the w-4 form at work congratulations on landing your job and welcome to the intimidating world of taxes now it's the time to fill out your first IRS tax form the w-4 form if you have already started working your employer has probably already had you complete that form all that matters for this form is the bottom of page 1 once we go over a few basics about the taxes you'll now pay will review the correct way to complete that form if are in less than 60 $300 in 2025 pretty much every employee pays these two taxes on each dollar earned you will pay 6.2 percent of each dollar you earn in Social Security taxes and these taxes go to fund Social Security benefits paid to retirees and disabled citizens you will also pay one point four five percent on each dollar earned in Medicare taxes to fund the Medicare system that provides health care to people 65 and older so for every 100 dollars that you learn 7.65 cents goes to these two taxes that's equivalent to one burrito from Chipotle but that's not all the taxes you might owe on that income you might also pay federal and state income taxes on those wages too while the rules for each state vary you will generally only all federal income taxes if your wages exceed $6,300 in 2025 if you work all year and are in less than sixty three hundred dollars you'll owe no federal taxes on that income unless you have a lot of money in investments in earn more than three hundred fifty dollars in investment income your total income exceeds a thousand fifty here is a problem you want to avoid...

Award-winning PDF software

Video instructions and help with filling out and completing What Form 2220 Completing