I've been a member of the bar in the state of Maryland since 1954. I became interested in the subject of federal taxation when I was sent by a local law firm to Capitol Hill to cover House Ways and Means and Senate Finance Committee hearings in drafting the 1954 Internal Revenue Code. After some 17 years of government experience, serving first as a clerk to a Tax Court judge and subsequently in the office of chief counsel of Internal Revenue, I entered private practice in 1973. I have had an active practice which majored and emphasized federal tax cases, representing taxpayers before the Internal Revenue Service and in the federal courts for approximately 28 years. I became very much interested in the last two years in the subject of Internal Revenue Service procedural matters. My concern has arisen over such matters as violations of IRS regulations by the service, violations of statutory requirements by the IRS, disregard of their own record system manipulations of data on the IRS master record system, ignoring statutory requirements for making proper assessment of taxes, the ignoring of requirements for collection matters such as the enforcement of IRS liens, levies, and property seizures. I also have a great deal of concern about a current trend toward abusive searches and seizures, which in my opinion so often violate the Fourth Amendment to the Constitution. One of my problems with what they're doing is they're making these assessments on these people that I feel like are not honest and are unfair. A monthly survey showed that something like 30% of the employees said they had seen examples of a taxpayer being treated unfairly, which means thirty thousand cases. I had to leave the IRS because I presented evidence that I had accumulated indicating that the agency was violating...

Award-winning PDF software

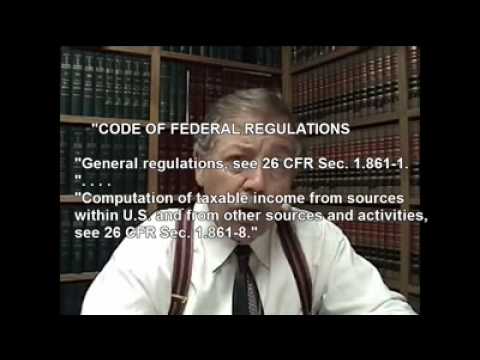

Video instructions and help with filling out and completing Where Form 2220 Revenue