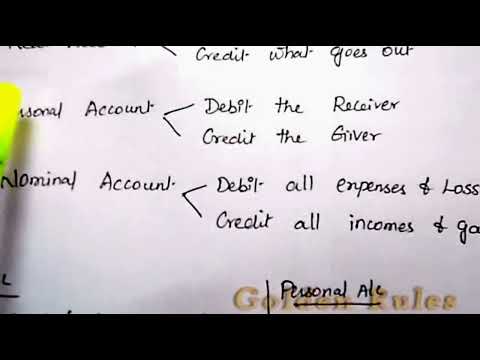

Hi, in this video, I am going to explain how to prepare a trial balance. Before that, we need to have some basic knowledge about accounts. Accounts are the art of recording all the transactions in the books of accounts. This is called accounts, okay? So, of course, the first thing is a journal. A journal is a book where we used to record all the transactions in a systematic manner, in a proper way. We need to record all the transactions for that purpose. We need to have a journal. The journal is only for recording all the transactions. After recording all the transactions into the journal, the second step is we need to group the similar kind of transactions. For that purpose, we need to have a ledger. After preparing the ledger, the third step will be a trial balance. A trial balance is not an account, it's only a statement which shows debit balances and credit balances of all accounts in the ledger. We just need to list all the items which we have prepared in the ledger and with this information, they ask you to prepare a trial balance. So, in order to prepare a trial balance, you need to understand two things: debit and credit. So, you need to have a thorough knowledge about debit and credit. The only thing you are going to do is write each and every item in a particular column and enter the amount either on the debit side or credit side. In order to identify whether the particular item belongs to debit or credit, you need to have thorough knowledge of the golden rules. Do you know the three golden rules? No? So, you need to have thorough knowledge about real accounts, nominal accounts, and personal accounts. First, you need to identify...

Award-winning PDF software

Video instructions and help with filling out and completing Which Form 2220 Accounting