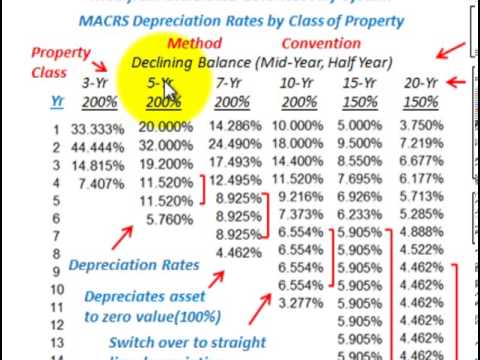

Here are just been going over an overview of this maker's tax depreciation system. This is a requirement by the Internal Revenue Service (IRS) of the United States government for corporations when they're depreciating their assets for tax reporting. So, what does this maker stand for? The maker stands for the Modified or Accelerated Cost Recovery System (MACRS). Corporations normally use the Generally Accepted Accounting Principles (GAAP) for their book depreciation, but for tax reporting and taxes, they have to use the MACRS system. The MACRS depreciation tax basis has three main elements. Number one, it has a mandated tax life generally shorter than the economic life. GAAP uses the economic life of the asset, while MACRS uses a tax life predetermined by asset category. Number two, the cost recovery is on an accelerated basis. And number three, an assigned salvage value of zero to the asset. This means that the asset is depreciated to a zero value with no salvage value at the end of its MACRS life. Now, let's look at a typical tax table that shows the percentages of depreciation allowed per year for different property classes. Each property class represents a group of assets with a specific tax life. For example, a three-year property class might include tooling or small equipment, while a five-year property class might include cars or trucks. The depreciation method and convention depend on the property class and can include declining balance or straight-line options. It's important to reference IRS publications to determine how to depreciate assets under the MACRS system. The publications provide information on general depreciation systems (GDS), alternative depreciation systems (ADS), declining balance and straight-line methods, and different conventions based on the placement date of the asset. Each item of depreciable property belongs to a specific property class with a defined life. The...

Award-winning PDF software

Video instructions and help with filling out and completing Which Form 2220 Depreciated