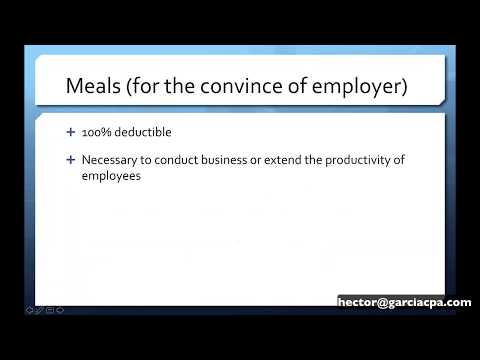

Welcome, everyone, to Tax Power. My name is Hector Garcia, and I'm your host. This is the monthly webinar for February 2017. Today is February 1st, 12:00 p.m. Eastern. Tax Power Hour is a small business and self-employed tax Tips & Tricks monthly webinar. Today's episode is about commonly misunderstood tax deductions. This comes from my experience, and we're going to have a guest speaker here as well. We will be focusing on meals and entertainment, travel meals, meals for employees, personal vehicle mileage deductions, and the home office deduction. We will spend about five minutes on the introduction and other events we are involved with, 50 minutes on meals and entertainment and travel meals, 10 minutes on personal vehicle mileage deductions and record-keeping tips, 10 minutes on home office deductions, and then we will have a Q&A session. You can ask questions throughout the webinar, and we will answer some of them verbally. We apologize for any misspellings or mistakes that may occur. Tax Power is a small business and self-employed tax Tips & Tricks webinar series. If you are attending live, you don't need to do anything else. If you are watching the recording, you need to register to attend. The webinar is currently free, but there may be a paid service in the future. We have a website under construction, taxpower.org, where we will add the video recording and notes from today's episode. We also have a Facebook group for ongoing discussions and questions. For generic tax questions, the Facebook group is the best place to go. For specific tax questions, email us or schedule an appointment. The webinar series is held every first Wednesday of the month and lasts between 30 and 60 minutes. There may be special episodes with sponsored content to keep the webinar...

Award-winning PDF software

Video instructions and help with filling out and completing Who Form 2220 Mileage