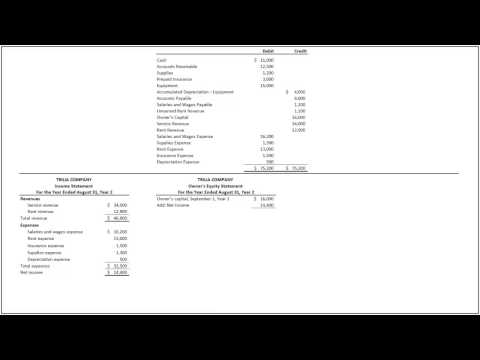

In this video, we will see how to prepare financial statements from an adjusted trial balance. An adjusted trial balance is a list of all the balances of ledger accounts after the preparation of adjusting entries. It ensures the arithmetic accuracy after making the adjustment entries in the records. It contains balances of revenues and expenses along with those of assets, liabilities, and equity. Since an adjusted trial balance contains all the data needed for financial statements, it is the primary basis for the preparation of financial statements. The financial statements comprise the income statement, owner's equity statement, balance sheet, and statement of cash flows. The preparation of the income statement is the first step in preparing the financial statements. It is prepared to determine the net income of a company in a period. To prepare an income statement, all income and expense accounts are considered. The statement of owner's equity is prepared to find out the closing balance of the owner's equity. It is prepared by using the owner's capital and drawings accounts, as well as the net income or net loss from the income statement. The balance sheet is prepared to know the financial position of a company. It is prepared from the asset and liability accounts, as well as the ending owner's capital balance as reported in the owner's equity statement. A statement of cash flows summarizes information about the cash inflows or receipts and outflows or payments for a specific period of time. Let's look at an illustration to see how to prepare financial statements from an adjusted trial balance. The adjusted trial balance of Trillian company is provided. We will prepare the income statement, statement of owner's equity, and balance sheet as of August 31st. First, let's prepare the income statement. The first step in...

Award-winning PDF software

Video instructions and help with filling out and completing Why Form 2220 Adjusted