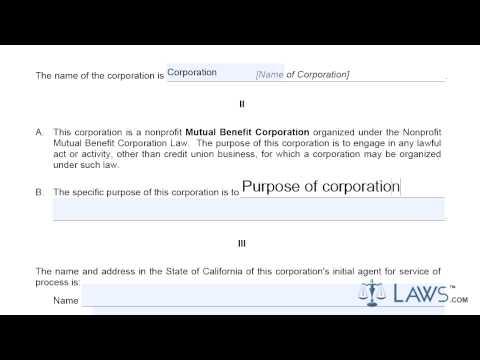

Laws calm legal forms guide organization of California non-profit non-stock corporations this form is used to form a non-profit non-stock corporation in California for religious charitable social education recreational or purpose of the like you're encouraged to consult with an attorney while completing this form step one prthe name of the corporation in article one make sure the name meets the California Standards visit the following link for more information step to the statement within article to a as required by law for a mutual benefit corporation public benefit corporation or religious corporation do not alter this statement in any way step three prthe specific purpose of the corporation in article to be indicate if the corporation plans to apply for the state franchise tax exemption step 4 article 3 requires information about the corporation's initial agent if the agent is an individual person include the agents name and their business or residential street address do not pra p.o box address or a CEO if the initial agent is a corporation do not write down an address in order to have a corporation as an initial agent the corporation must be filed under the Secretary of State step 5 article 4 and article 5 are required by law and should not be altered in any way an attorney may suggest different phrasing in some cases step 6 each incorporator needs to sign the bottom of the form type the name below the signature as well step 7 the filing fees for the Articles of Incorporation for a non-profit non-stock corporation are thirty dollars if the forms are dropped off to the Sacramento office or the los angeles regional office an additional fifteen dollars is required step 8 attach the filing fees and any other required documents and mail or delivered...

Award-winning PDF software

Video instructions and help with filling out and completing Why Form 2220 Organizations