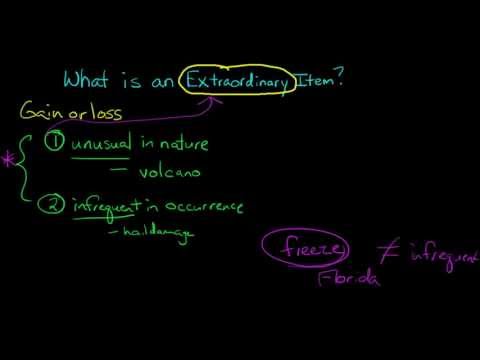

Well, if you've looked at enough income statements, you might have come across something called an extraordinary item. You might be wondering, what is so extraordinary about it? An extraordinary item is essentially a gain or loss that has two critical properties. First of all, it's unusual in nature. It's not something that you would normally think would be associated with your business's operations. For example, a volcano erupting and wiping out one of your manufacturing plants. That's something unusual that's not really related to your business. It's kind of a freak event that you didn't see coming. But it's not enough for it to be unusual. It also has to be infrequent in occurrence. So, we have to have both. You might say, "We have this terrible storm with hail damage." But now we have to ask, how frequent is that hail? Did a similar storm happen three years ago? Does it happen every 10 years? If it's not infrequent, then it's not extraordinary. It has to be both unusual and infrequent. A good example of something that is unusual but not infrequent is a freeze on crops in Florida. It might happen every four or five years, so it's not something that happens every year. But it does happen frequently enough that it can't be considered infrequent. We have to meet both tests for it to be an extraordinary item. So, you can see that determining what's extraordinary and what's not involves some discretion. Extraordinary items are rarely reported on an income statement. Maybe less than 1% of firms actually report them.

Award-winning PDF software

2220 extraordinary items Form: What You Should Know

Underpayment of Estimated Tax by Corporations (Fiscal year ending Dec. 31, 1999 – 2018) Underpayment of Estimated Tax by Certain Businesses (Florida Tax) Underpayment of Estimated Tax by Special Firms (Florida Tax) This form can be used to determine if you paid the correct amount of estimated tax by the due date for payment. If the due date is not established, filing a subsequent claim for refund may be the preferred course of action. Underpayment of Estimated Tax by Certain Businesses (Florida Tax) This information form is available in both electronic and paper formats for use as a form of electronic filing. If the IRS determines that you did not file Form 2555, you may be eligible for an IRS examination if you owe any taxes. More about Underpayment of Estimated Tax by Certain Businesses (Florida Tax) Information about the Underpayment of Estimated Tax by Certain Businesses (Florida Tax) This form may be used to determine an estimated tax payment that is equal to less than any amount claimed on the return. For details about the tax liability, ask the taxpayer for a copy of the return or other documentation that shows the correct tax paid. You can obtain a copy of an individual's tax return through the IRS' “Get Transcript” site, or you can use U.S. mail to request a copy. If you require an electronic transcript, you will need to complete Form 2655, “Underpayment of Tax Due” and submit a paper copy to the customer service center for the taxpayer located at the address provided on your form; to obtain a paper copy of the transcript, you must complete Form 2555, “Underpayment of Estimated Tax Due.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 2220, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 2220 Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 2220 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 2220 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 2220 extraordinary items